will child tax credit monthly payments continue in 2022

As part of the federal governments pandemic response the 2021 expansion of the Child Tax Credit increased the amount of the credit made more families eligible for the tax credit and. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

What Families Need To Know About The Ctc In 2022 Clasp

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Those returns would have information like income filing status and how many children are.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The advance child tax credit payments were based on 2019 or 2020 tax returns on file. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

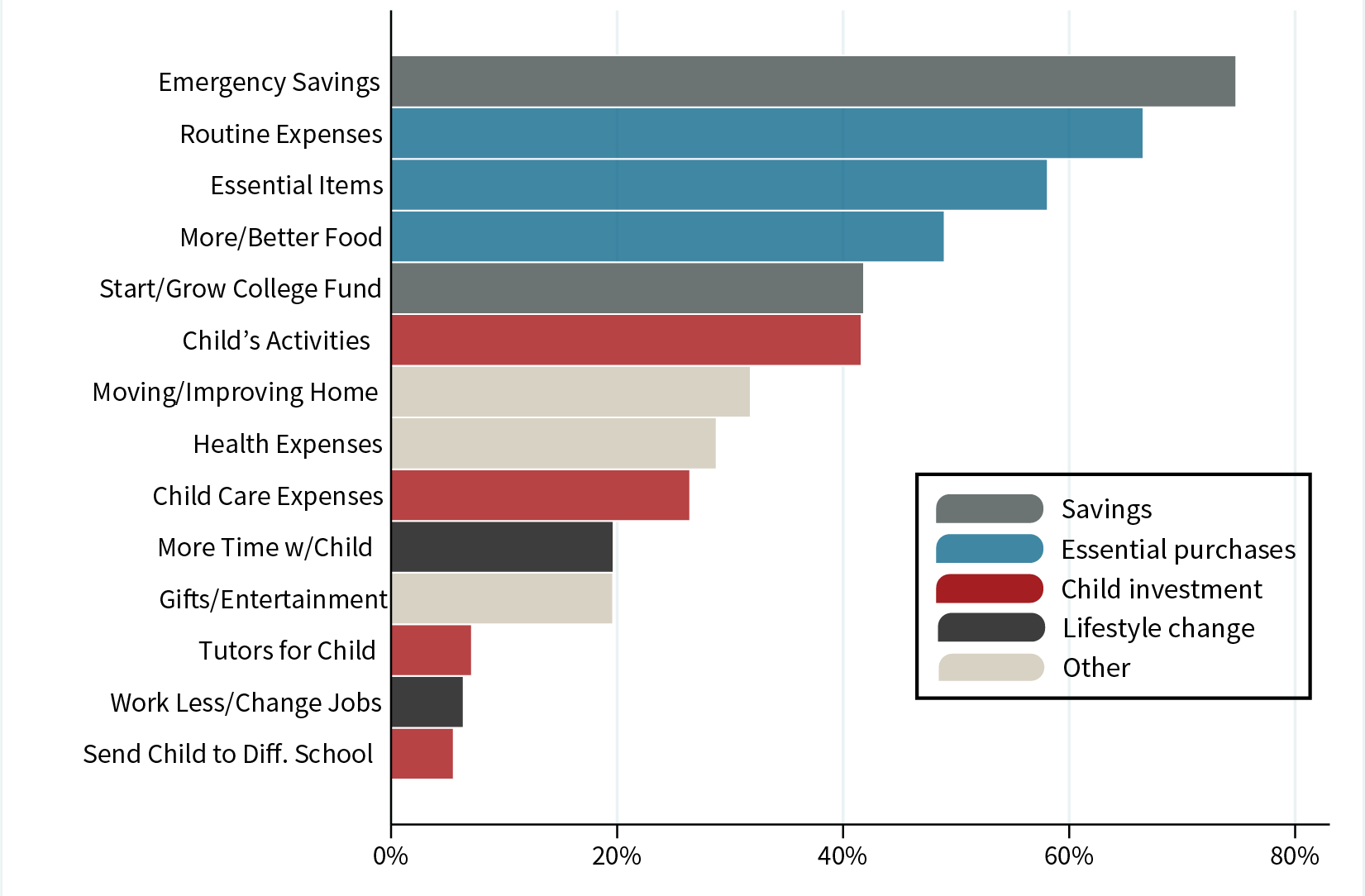

The New Child Tax Credit Does More Than Just Cut Poverty

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Child Tax Credit The White House

Child Tax Credit Here S What To Know For 2022 Bankrate

Rep Henry Cuellar On Twitter I Voted For The Child Tax Credit Because It Helps Lift Children Out Of Poverty And Keeps More Money In The Pockets Of American Families I Will

Future Child Tax Credit Payments Could Come With Work Requirements

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

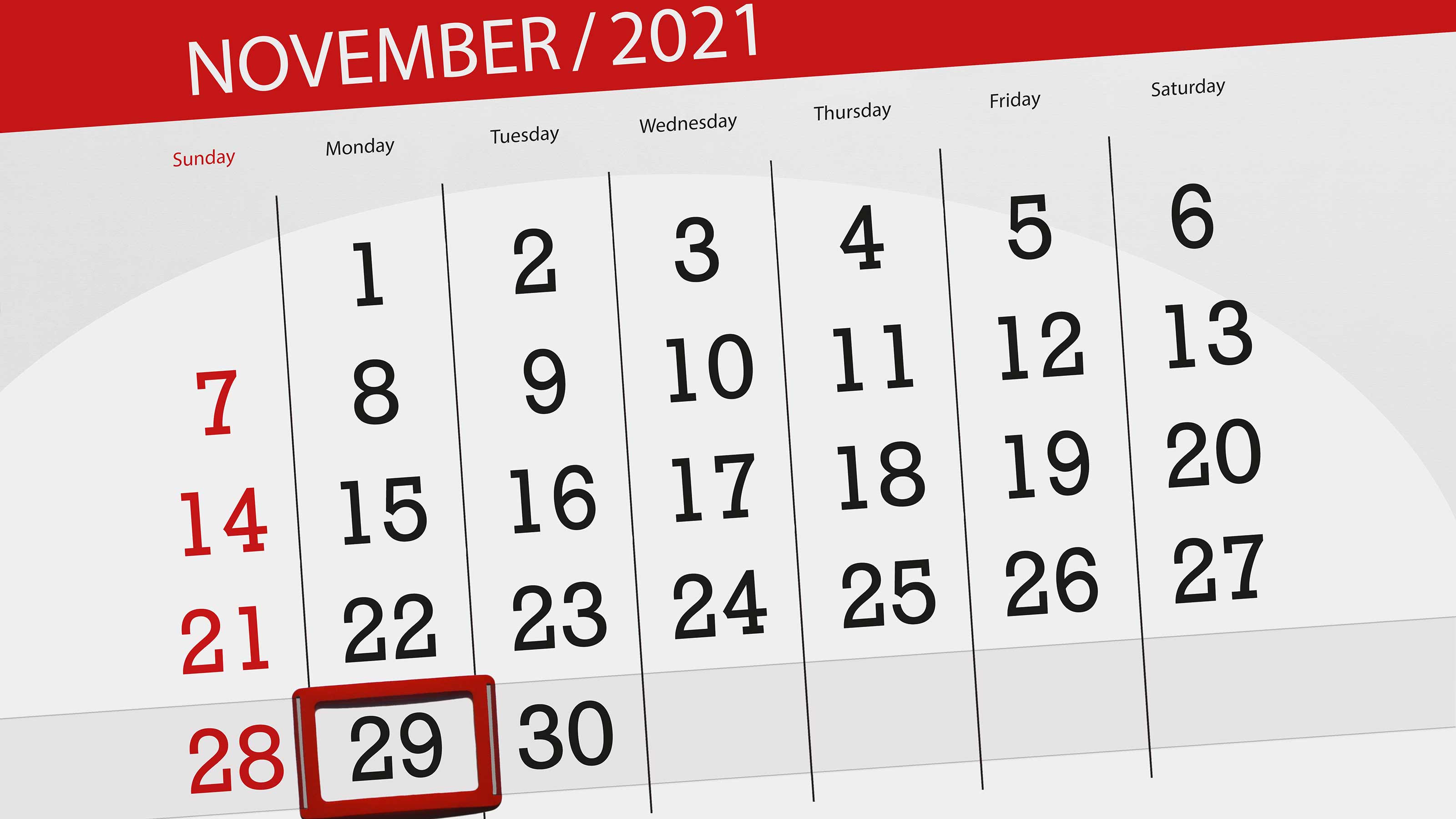

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Irs Sends Out Final Child Tax Credit Payments 11alive Com

Child Tax Credit Will There Be Another Check In April 2022 Marca