nassau county property tax rate 2020

January 30 2020 528 PM CBS New York. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

What is the property tax rate for Nassau County.

. The class one level of assessment for recent tax years prior to 2020-2021 including 2017-2018 was 25. Save money on Nassau County Property Tax. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Fernandina Beach FL 32034. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Cobra Consulting Group LLC. Nassau County Tax Lien Sale. Without it about half of Nassau County homeowners whose property assessed values increased may have faced significantly increased tax liability this Fall.

Nassau County - Bay Park Road Maintenance Facility 516-571-6900 516-571-6900. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. Download all New York sales tax rates by zip code.

Pushback Over Nassau Countys New Property Tax Reassessment As Homeowners Get School Tax Bills December 14 2020 631 PM CBS New York ROCKVILLE CENTRE NY. It is also linked to the Countys Geographic Information System GIS to provide. Liber Page Deed.

The median property tax on a 48790000 house is 512295 in the United States. What is the tax cap for 2020. Homeowners across Nassau County are due for changes to their property taxes with.

Rules of Procedure PDF Information for Property Owners. Nassau County Tax Collector. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales.

Nassau and Suffolk Property Tax Reduction Specialist Call Us. A recipe for disaster. Since taxes are going up you will pay more unless you reduce your assessment.

Whether its the county town or school tax rate. The Nassau County executive said residents will have until July 1 to submit their second-half school tax payments and late fees wont be calculated before that date. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

The median property tax on a 48790000 house is 600117 in New York. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes. Mar 04 2020 1027pm Updated on Mar 29 2021.

How to Challenge Your Assessment. If you have any question concerning your Nassau County commercial property taxes due to COVID-19 or otherwise please feel free to contact Andrew M. These increases are far higher than what is seen in an ordinary year and 2020 has been far from an ordinary year.

What is the property tax rate in Nassau County NY. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Across Nassau County residential property values increased by 119 percent in the same time period.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. The County Assessor has set the class one level of assessment for the 2020-2021 tentative roll at 10 to ensure that the roll is accurate and defensible. The median property tax on a 48790000 house is 873341 in Nassau County.

86130 License Road Suite 3. But after the family redid the home in 2018 in part to accommodate Stines sister taxes jumped to 31134 for 2020-21 22444 for schools and 8690 for general county and town property. So far Suffolk Countys deadline for its annual property taxes remains May 31.

Fighting property taxes in a pandemic Curran reassessed properties for the 2020-21 tax year according to Newsday after an eight-year freeze during the previous decade. You can pay in person at any of our locations. The Nassau County Sales Tax.

CBSNewYork - School tax bills. Assessment Challenge Forms Instructions. Tax Class 1 Res Prognose 2021 Only.

Nassau County Department of Assessment ASIE 2020. CBSNewYork -- New property assessments are in the mail for Nassau Countys 15 million residents and that means taxes could be going. Open and Paid Taxes Info.

The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment. COVID-19 Nassau County property taxes 145 pm Mon April 20 2020 Long Island Business News David Winzelberg.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

5 Myths Of The Nassau County Property Tax Grievance Process

Florida Property Tax H R Block

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

Mortgage Rates Drifted Higher On Optimistic Economic News Mortgage Rates Lowest Mortgage Rates Bankrate Com

Who Pays Taxes In Fernandina Beach An Opinion Fernandina Observer

Property Taxes In Nassau County Suffolk County

Nassau County Ny Property Tax Search And Records Propertyshark

Pin On Mortgage And Finance Tips

Property Taxes In Nassau County Suffolk County

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

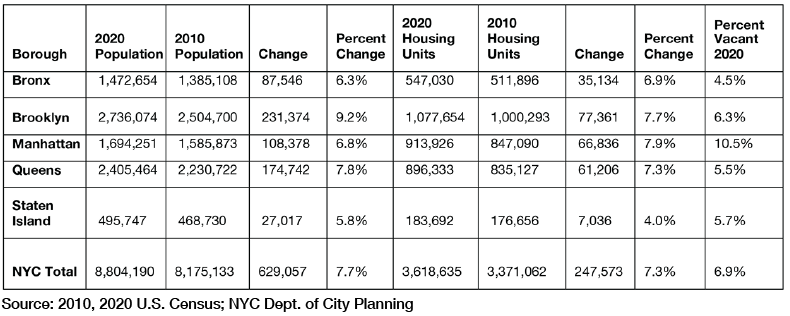

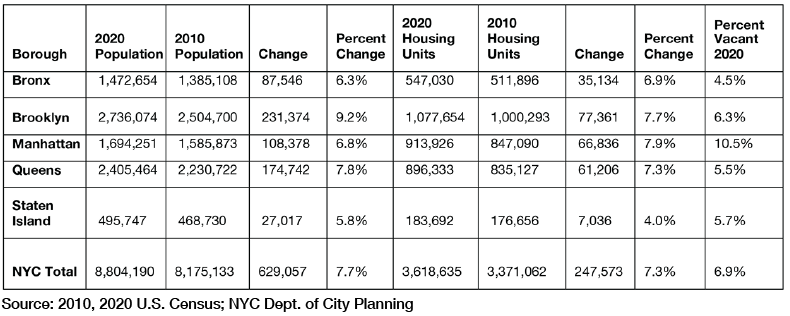

Can T Keep A Great City Down What The 2020 Census Tells Us About New York Manhattan Institute

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Property Taxes In Nassau County Suffolk County

Treasury 5 Year Yield Falls To Match Record Low Tax Return Filing Taxes Tax Filing System

New York Property Tax Calculator 2020 Empire Center For Public Policy

Us Homes Are Now More Valuable Than Ever House Prices Real Estate Redfin